- Best Practices New Normal

- Digital Dentistry

- Data Security

- Implants

- Catapult Education

- COVID-19

- Digital Imaging

- Laser Dentistry

- Restorative Dentistry

- Cosmetic Dentistry

- Periodontics

- Oral Care

- Evaluating Dental Materials

- Cement and Adhesives

- Equipment & Supplies

- Ergonomics

- Products

- Dentures

- Infection Control

- Orthodontics

- Technology

- Techniques

- Materials

- Emerging Research

- Pediatric Dentistry

- Endodontics

- Oral-Systemic Health

Does your accounts receivable need CPR?

You have been looking at your production numbers and your collections numbers and they seem okay with a “little shortfall” each month in collections, so why are you stressed when you sit down to sign the payroll checks and pay the bills?

Frustration and stress in the dental practice are clear indicators of management system shortfalls, but nothing screams “crisis” louder than a practice that is struggling financially. You have been looking at your production numbers and your collections numbers and they seem okay with a “little shortfall” each month in collections, so why are you stressed when you sit down to sign the payroll checks and pay the bills?

The key statistics that every practice needs to monitor must include understanding the accounts receivable (AR) numbers. When you have a “little shortfall” from your collections each month, these account balances are aging on your accounts receivable. If your accounts receivable are growing, it is costing you more and more to collect each dollar.

Benchmarks for measuring the health of your financial system through the accounts receivable are:

1. The total of the accounts receivable should be no higher than one half of a month’s average production.

2. The over-90-day account balances should be no more than two to three percent of the in-control goal amount for your AR. (If your software system ages beyond 90 days you will need to add all column totals from 90 and older together and then divide by the total to find your percentage.)

3. Insurance claims should never be in the 90-day-or-older columns.

Exceptions: if the claim is the secondary it is possible it might age into the 90-day-past-due column. If you are filing both medical and dental claims it is likely that one of the claims may be aging beyond 90 days. And finally, if you are dealing with state or federally-funded Medicaid plans, it is possible the claims may be in the 90-day-and-older columns.

When monitoring your AR statistics you will want to have it provided to you in a month-to-month comparison, it will assist you in seeing trends.

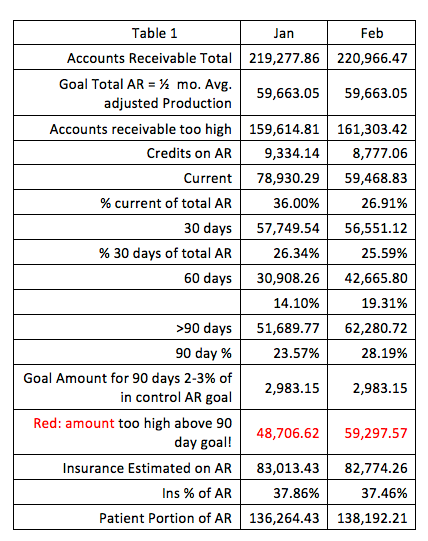

Table one reflects an AR that is very high, well above the goal for this practice. From January to February, the total grew slightly, however, the expectation would have been for the AR to decline because the collections goals would be based on collecting over 100 percent each month to decrease this out of control AR.

Continue to page two for more...

The current column is higher or equal to the goal for the entire AR. What this indicates is that the over the counter collections are not to goal. Over-the-counter collection percentage represents a good way to track how well your business team collects the co-pays. Over-the-counter collections (OTC) refer to the portion of your fee that you collect from today’s patient today. Industry standards range from 35 to 45 percent of production should be your OTC goal: this is dependent on how much of the production is insurance based.

The more contractually aligned the lower the percentage for OTC will be for your practice. This is a part of the AR management system that I recommend be implemented immediately in this office. Watching what should have been collected as opposed to what was collected will help the practice begin to focus on collecting today’s due dollars today.

The over-90-day accounts represent more than 25 percent of the amount due to the practice and from January to February it grew by $11,000. If the practice doesn’t focus on collecting the current, 30 and 60 days, it is going to end up in the 90-day column where it becomes more and more difficult to collect.

Is your practice only sending statements? Who is responsible to call all past due (greater than 30 days) accounts each month? Are the calls documented, do you have the business team provide the practice the total number of calls made each day, how much was due and how much was collected? Is your AR system standards and expectations documented, does the team know what to do each step of the way, do you have financial options you offer for your patients and are they being offered etc.?

The insurance outstanding at almost 40 percent of the amount due is of a concern; the easier money to collect is the insurance dollars. If you submit claims electronically the day of service with the expected documentation and narratives, the insurance payments will be made before this treatment can age into the 30-day column. What is your insurance follow-up system, when is it being worked, who does it, have you printed an insurance claims aging report and looked at it? With focus here the insurance could be tracked and the claims paid before the end of the year, decreasing your accounts receivable and increasing your collections.

Continue to page three for more...

The financial system is out of sync in table one. Refocus on the financial guidelines by:

1. Making sure you have signed, agreed-on payment options when credit is extended. Be sure to utilize your health care financial partners; the practice is not a bank, let your health care financial partners extend the patients credit. My go-to recommendation is CareCredit they have been helping dental patients have their dentistry today and pay for it over a period of time for years.

2. Collecting all estimated patient portions at the time of service, increasing your OTC percentage and decreasing your accounts receivable by those patient portion dollars.

3. Following up on all past due insurance claims once they are 21 days past due, don’t wait until they are 30 days past due, keep in mind if you don’t ask you won’t get. Ask the insurance company for what they owe so you can get that claim moving ASAP.

4. Calling all past due accounts to secure payment(s) on the past due balances.

All of these steps will help the practice to improve the collections and the cash flow of the practice.

That which is measured can be changed, take a look at your accounts receivable every month comparing it to previous months and watch for changes that indicate the totals are growing. Then evaluate if it is patient portion due that needs focus or the insurance management system.

Are you on your way to financial success or does your accounts receivable need CPR? Will you cling to what you've always done through the rest of 2015 and hope that by some miracle your financial situation improves? Or will you take action and ensure that it does?