- Best Practices New Normal

- Digital Dentistry

- Data Security

- Implants

- Catapult Education

- COVID-19

- Digital Imaging

- Laser Dentistry

- Restorative Dentistry

- Cosmetic Dentistry

- Periodontics

- Oral Care

- Evaluating Dental Materials

- Cement and Adhesives

- Equipment & Supplies

- Ergonomics

- Products

- Dentures

- Infection Control

- Orthodontics

- Technology

- Techniques

- Materials

- Emerging Research

- Pediatric Dentistry

- Endodontics

- Oral-Systemic Health

How basic estate planning protects individuals and legacy: Part 1

Estate planning can help you protect and care for yourself, your family and your practice.

Estate planning is not a financial concept for just high-income individuals. These concepts apply to everyone, regardless of age or net worth. These concepts can not only help individuals protect and care for themselves and their families at the time of death, but also during their lifetime.

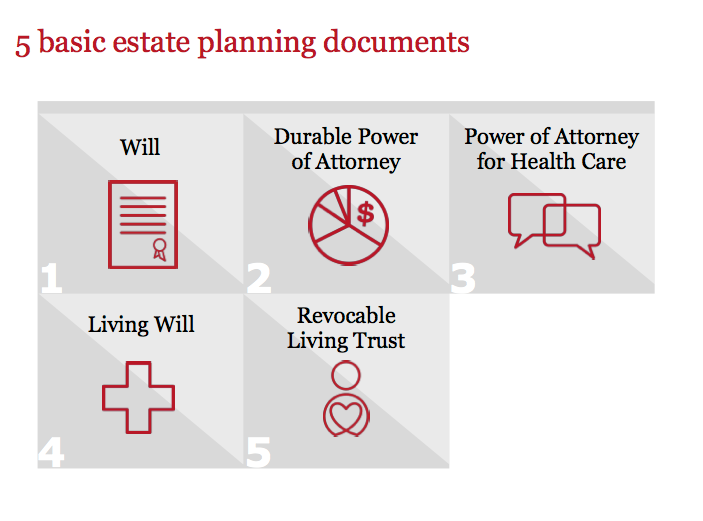

There are five key estate planning documents - four of which everyone should have.

As part of a basic estate plan, individuals should have a will, a durable power of attorney for financial matters, a health care power of attorney, and a living will. These documents will help you control your assets and health care decisions while you’re living and at death.

Trending article: 9 ways EHRs save time and money

Some people may add a revocable living trust. The first four documents provide the foundation for any estate plan and help individuals stay in control.

If you already have these documents, be sure to review them regularly. Life events, such as deaths, births, divorces, marriages, inheritances, or a change in state residency, lead to changes in one’s goals–so these documents should change accordingly.

It is important to update estate planning documents when moving from one state to another because state laws vary. It is important to make sure that the documents are designed to work well in the state where you live. You also should review these basic documents as changes occur in federal or state estate tax laws.

Will accomplishes plenty

A will accomplishes a number of objectives. First, it provides direction for the distribution of assets to family and other beneï¬ciaries upon death. An attorney can customize its provisions to meet your needs. You appoint a personal representative (known as an “executor” or “executrix”) to account for your assets, liabilities, final expenses, any taxes due, and distribution of remaining assets.

A will also is the only way to designate a guardian for minor children. Should something happen to you, a judge still must approve this appointment, but at least you have expressed your wishes through this document. If you have minor children, it is wise to include a trust to manage assets for them - at least until they reach age 18.

A will must be filed in probate court to be effective. Probate is a judicial process for managing your assets if you become incapacitated and for transferring your assets in an orderly fashion upon death.

The court oversees payment of liabilities and the distribution of assets. Generally, your executor will need to employ an attorney. Since a will does not take effect until death, it cannot provide for management of your assets if you become incapacitated.

Durable power of attorney

This is the reason why you also want to have a durable power of attorney. This document lets you name another trusted person to manage your financial and business affairs during your lifetime, if you are unable.

A general durable power of attorney allows your agent to perform all duties you typically perform, whereas a limited durable power of attorney covers only specific events, such as selling property or investing assets.

Read more: These 3 mistakes could cripple your next office lease negotiation

Your agent should act in your best interest with financial and business affairs, maintain accurate records, keep your property separate from his or hers, and avoid conflicts of interest. This person will be able to sell, invest, and spend your assets. It becomes imperative to select someone you trust.

You can give this power to that person immediately, or your attorney can write in a “trigger” that prompts that person to take over for you (such as being designated incapacitated by one or two physicians, as specified in the document).

Which is better? There’s no right or wrong answer. Discuss with your family and your attorney what might be suitable for your situation.

If possible, it is wise to name both a primary and a back-up (a contingent) agent. This will be helpful if the primary agent predeceases you.

Continue to page two to read more...

Healthcare power of attorney

A power of attorney for healthcare is similar to a durable power of attorney for financial matters, but this document gives someone the power to make medical and healthcare decisions for you if you are not able. This document avoids court intervention and allows you to empower a person you trust to make decisions on your behalf if you are unable to communicate those wishes.

You need to have a frank conversation with the person handling your affairs about how you want your medical care handled, especially in the event of a terminal illness.

Living will

Unlike a healthcare power of attorney, a living will establish your wishes for life-prolonging medical care should you become incapacitated. These are called advanced directives, or health care directives. A key advantage of this document is that it states what you want relating to end of life care.

Revocable living trust

The previous four documents are essential as a starting point. This fifth document–a revocable living trust–is one that you may want to discuss with an attorney. It may be suitable for your situation, but in some cases, the attorney may suggest that it is not necessary.

Related reading: Dental practice transitions and real estate conveyances

If your attorney suggests creating such a trust, you can be your own trustee. You receive all of the income from the trust assets, and you have full access to the trust principal.

A revocable living trust can be altered at any point during your lifetime. You can change beneficiaries or discontinue the trust at your discretion.

At your death, this trust becomes irrevocable. The person you name as successor trustee will follow the instructions in the trust to manage the assets and liabilities and to distribute the assets in trust.

You should know that ongoing management affects only assets that you have retitled in the name of the trust. If your attorney suggests a revocable living trust, you will want to follow his or her instructions regarding retitling assets and accounts.

You still need a “pour-over” will to govern assets that are not titled in the name of the trust, and also to appoint guardians for minors.

Other advantages of a living trust are the successor trustee can manage the assets on your behalf if you become disabled or incapacitated during your lifetime. Assets in the trust then avoid the probate process upon death.

Since you maintain control of the assets within the trust, they remain part of your taxable estate. However, a revocable living trust can also include provisions to help reduce estate taxes after your death.

Editor’s Note: This article is the first part of a two-part series on the basics of estate planning. This article will introduce and explain the basic estate planning concepts. The second article will address the roles and responsibilities of persons involved in estate planning and the types of assets associated with beneficiary designations. Part two of the series was published in the Dec. 1 issue of Ophthalmology Times.