- Best Practices New Normal

- Digital Dentistry

- Data Security

- Implants

- Catapult Education

- COVID-19

- Digital Imaging

- Laser Dentistry

- Restorative Dentistry

- Cosmetic Dentistry

- Periodontics

- Oral Care

- Evaluating Dental Materials

- Cement and Adhesives

- Equipment & Supplies

- Ergonomics

- Products

- Dentures

- Infection Control

- Orthodontics

- Technology

- Techniques

- Materials

- Emerging Research

- Pediatric Dentistry

- Endodontics

- Oral-Systemic Health

Survey examines dental practice investments

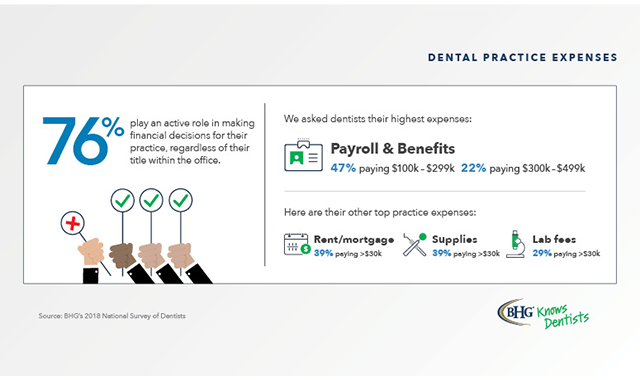

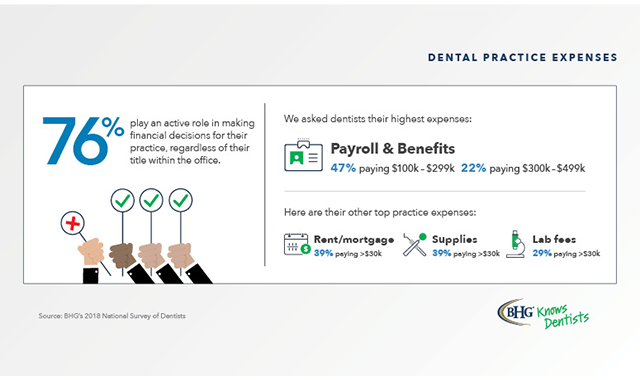

Three out of four dentists play an active role in making financial decisions for their practice.

A national research study from Bankers Healthcare Group, a leading provider of financial solutions for healthcare professionals, examines how dentists manage their business finances and investments. BHG surveyed more than 400 dental professionals (both practice owners and associates) to better understand their financial decision making and how they’re investing to maintain and grow their practices/services.

Making financial decisions

Three out of four dentists (76 percent) play an active role in making financial decisions for their practice, regardless of their title within the office. These decisions include budgeting, investments and borrowing.

Read more: Survey shows dentists concerned about declining reimbursement rates

Among practice owners only, 60 percent make financial decisions on their own, while 27 percent make them jointly with others. The remaining 13 percent are hands-off in financial decision making, relying on others such as practice partners, office managers or a financial adviser. Those aged 35 and older skewed higher on sole decision making, while younger practice owners were more likely to tap other experts to make financial decisions.

Among associates (nonpractice owners), those aged 35-49 and who practice with only two or fewer other dentists are more likely to be involved in their practice’s financial decisions.

Practice expenses

Practice owners surveyed say payroll and benefits are their highest expenses, with nearly half (47 percent) estimating an average annual spend $100,000-$299,999, while about a quarter (22 percent) estimate spending $300,000-$499,999.

Hiring office staff is the most frequently incurred significant financial investment for dentists. One-quarter said their practice hires office staff every two to three years, while another 22 percent hire annually. Upgrading or purchasing new equipment is also a frequent larger financial move, with 20 percent indicating they’re likely to do this every year.

Trending article: Surprised with your 2018 tax bill?

BHG asked respondents to estimate how much they spend on average for other annual practice costs. Top expenses include:

- Dental supplies: 32 percent report spending more than more than $30,000

- Office rent/mortgage: 39 percent spend more than $30,000

- Lab fees: 29 percent of owners estimate they spend over $30,000

Lower expenses include:

- Marketing: 43 percent report spending less than $3,000

- Continuing education: 41 percent of owners spend less than $3,000

Borrowing habits

Almost half of all dentists (44 percent) surveyed said they’ve taken out a commercial loan and 40 percent have taken out a personal loan. The most common uses of a business loan include:

- Start/open practice/healthcare business: 50 percent

- Working capital: 41 percent

- To finance expansion/equipment: 32 percent